Highclere International Investors – International Small & Mid Cap Equity Specialist

International Small & Mid Cap Equity Specialist

Independent investment boutique

International small and mid cap equity specialist

Two closely related investment programmes

Institutional client base

Employee ownedanchored by Silchester International Investors

London headquartersclient service in Westport, CT

Team based processcollegiate culture

Our story

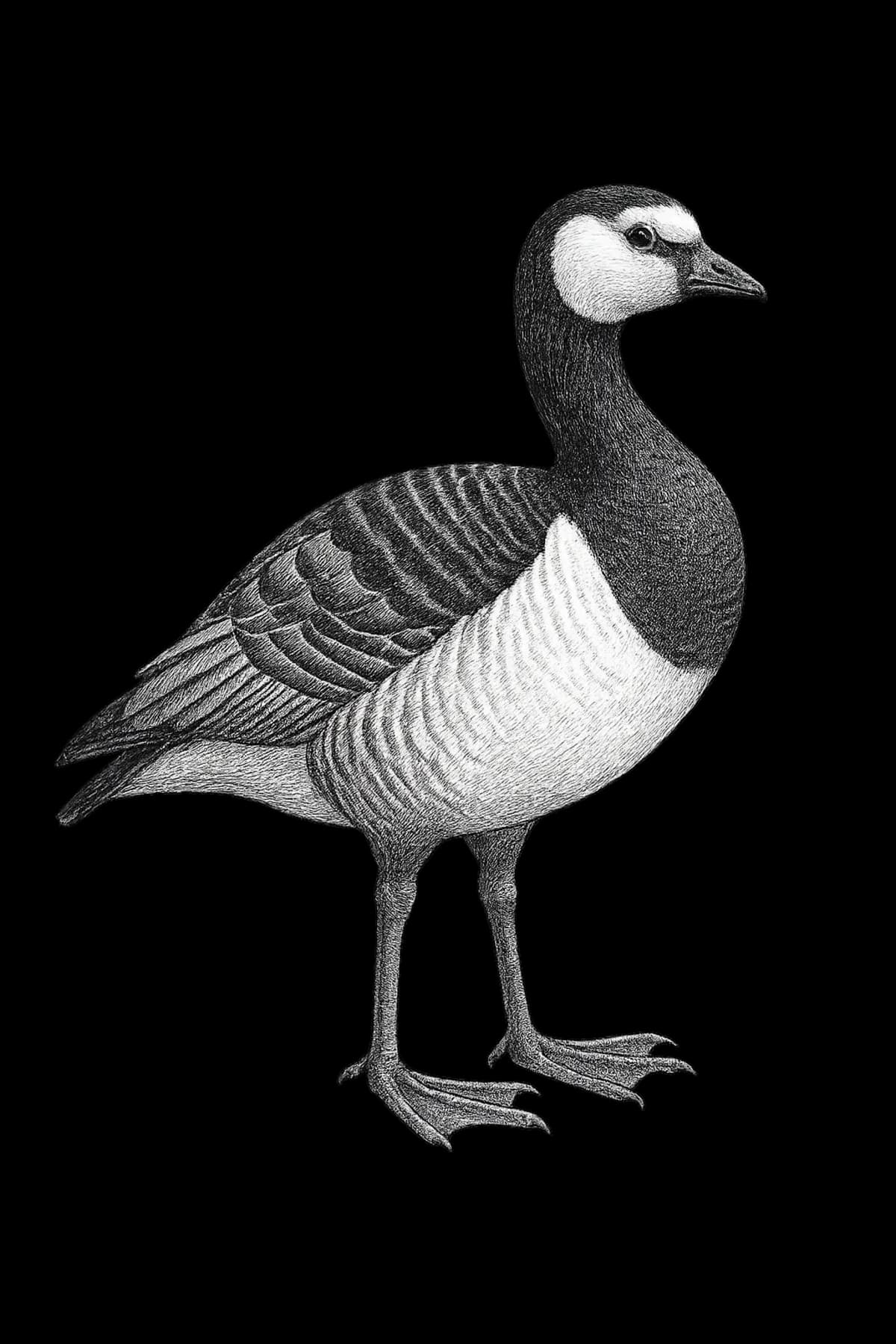

Hanging prominently in our London office, "Barnacle Geese Against a Stormy Sky" was painted by Sir Peter Markham Scott in 1939. Son of "Scott of the Antarctic", Peter was a renowned artist, ornithologist and conservationist.

Unusually, the geese are flying towards the storm rather than away from it, which is symbolic given the outbreak of World War II in the year it was painted. This imagery perfectly mirrors Highclere's contrarian investment philosophy.

This nonconformist approach was forged by Ed Makin in 1997 at Wellington Asset Management when he launched an international small cap investment programme during the dot com bubble. Having covered European large caps, he recognized that small caps offered greater opportunities for outsized returns, as they were less efficiently researched and largely overlooked by other analysts.

This paid dividends when the bubble burst and provided an invaluable grounding for the discipline of level-headed valuations matched with reasonable growth assumptions which has been the cornerstone of Highclere's investment philosophy ever since.

Ed decided to continue his international small and midcap investment journey under his own banner in 2006 when he left Wellington to form Highclere. This was done with the backing of Silchester International Investors and their founders with whom Ed had worked in his early asset management years at Morgan Stanley.

The firm has grown over time and seen many market cycles since the dot com bubble, but the investment philosophy remains the same and continues to be implemented by an experienced team of small cap specialists.

We look forward to welcoming guests in our London office and introducing them to the team and Peter Scott's intrepid geese.

"Barnacle Geese Against a Stormy Sky" by Sir Peter Markham Scott